CTS full form : Cheque Truncation System

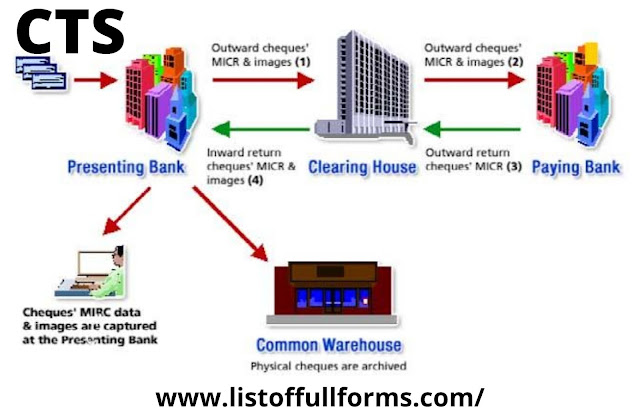

CTS represents Check Truncation System. It is a task of Reserve Bank of India which was propelled for quicker leeway of checks. It doesn't include physical exchange of checks starting with one bank then onto the next bank.

It is fundamentally an online picture based check clearing framework which uses check picture to clear the check. An electronic picture of the check alongside MICR number is sent to the drawee bank from the cabinet bank.

The physical instrument is shortened sooner or later in course to the drawee branch and an electronic picture of the check is sent to the drawee branch alongside the important data like the MICR fields, date of introduction, introducing banks and so forth.

This would dispense with the need to move the physical instruments across branches, aside from in extraordinary conditions, bringing about a compelling decrease in the time required for installment of checks, the related expense of travel and delays in handling, and so on., in this way accelerating the cycle of assortment or acknowledgment of checks.

|

Brief History

- The CTS was first launched in National Capital Region, New Delhi by Reserve Bank of India in February 2008.

- In September 2011, it was launched in Chennai.

- In 2013, RBI decided from 1 August 2013 only CTS-2010 cheques would be accepted by the banks for clearance, Later, in July 2013, this deadline was extended to 31 December 2013.

Advantages of CTS

- It spares time, cash and endeavors engaged with the physical development of checks.

- The checks clear quicker which brings about better client care.

- It improves the operational productivity of banking framework.

- It diminishes the odds of extortion identified with freeing from checks.

- No dread of losing checks on the way.

- No geological limitations.

For banks

Banks determine numerous advantages through the execution of CTS, similar to a quicker clearing cycle meaning actually conceivable acknowledgment of continues of a check around the same time.

It offers better compromise/confirmation, better client care and improved client window. Operational effectiveness gives an immediate lift to base lines of banks as freeing from nearby checks is a significant expense low income action.

In addition, it diminishes operational chance by making sure about the transmission course. Unified picture documented frameworks guarantee that information stockpiling and recovery is simple.

Decrease of manual assignments prompts decrease of blunders. Ongoing following and perceivability of the checks, less cheats with tied down exchange of pictures to the RBI are different advantages that banks get from this arrangement.

For clients

Consumer loyalty is improved, because of the diminished pivot time (TAT). It likewise offers better compromise what's more, misrepresentation avoidance.

For More Information Click Here

|

Tags

truncated cheque clearance procedures

disadvantages of cheque truncation system

cheque truncation system process flow

cheque truncation system ppt

cheque truncation system pdf

cheque truncation system in malayalam

what is cheque truncation system

cheque truncation system upsc

|

0 Comments