TAN full form : Tax deduction and collection Account Number

TAN represents Tax Deduction and Collection Account Number. It is given by Income Tax Department of India to those people and firms who are required to deduct or pay charge on installments made by them, under the Income Tax Act, 1961. Under Section 203A of the Income Tax Department, it is compulsory to give the TAN in all TDS returns and Challans while making good on charge.

Along these lines, TAN is the record number which is utilized to settle the assessment, without having a TAN you can?t cover the duty. On accepting the assessment sum the annual expense office checks the sum and on the off chance that the citizen has saved an additional duty accidentally, at that point the additional assessment will be credited go into his record.

Format of a PAN

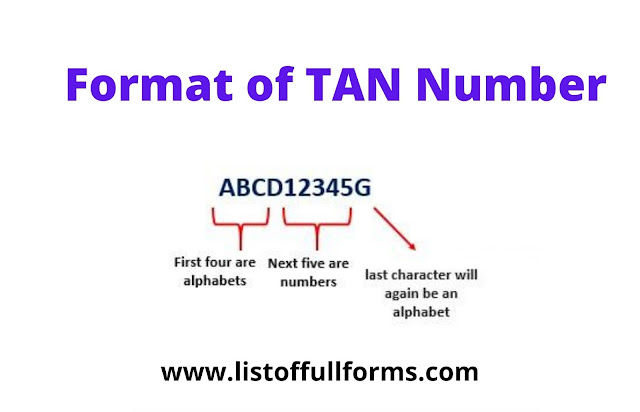

TAN is a ten-digit alphanumeric number. The initial three letters of TAN speaks to a city, the fourth letter is the underlying of the citizen and the following five numbers and the last letter make the TAN one of a kind.

Steps For Applying TAN number

1. For TAN top off the structure no. 49B. At that point append all the necessary archives, for example, personality verification and address evidence and submit it at the site of NSDL or Tax data organize assistance focus.

2.On accepting the TAN application structure, the NSDL division checks the subtleties and sends the application structure to annual assessment office.

3. The Income charge office favors the application and sends an interesting number (TAN) to the NSDL office.

4. The NSDL office illuminates the candidate about the TAN.

For More Information Click Here

0 Comments